Value Added Tax (VAT)– The Big Pie Everyone Wants

Over the past week, VAT appeared in big bold fonts across media channels. Some state Governments (read as Rivers and Lagos states) were demanding a bigger portion of the VAT pie. So, they made moves to enact laws that would enable them to collect the taxes internally (bypassing the Federal Inland Revenue Service- the tax authority currently responsible for VAT administration in the country).

A Background

The VAT regime in Nigeria is governed by the Value Added Tax Act of 1993 which replaced the Sales Tax. VAT is a tax paid on VATable goods and services and in 2020 it became the highest tax revenue purse of the Federal Government (NGN1.53trn). The Act specifies a sharing formula of VAT receipts as follows: Federal Government (15%), State Governments (50%) and Local Governments (35%). However, the Act predates the Nigerian Constitution which does not give specifications regarding the administration and collection of VAT. Hence, States like Rivers and Lagos (two of the top beneficiaries of VAT) could be successful in their attempt to enact VAT laws.

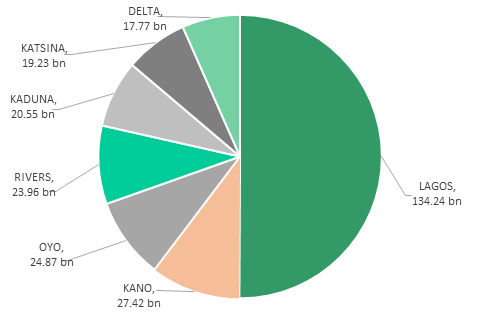

Chart: Top Beneficiaries form VAT Distribution in 2020

Source: NBS, Meristem Research

The Issues with State-Collection

First is the conflict between the Federal VAT and State VAT laws. The Finance Act of 2020 made a VAT exemption for small businesses with revenue below NGN25mn. Businesses in this category would have to comply with their state VAT laws, which could imply the remittance of VAT by small business owners. Also, in some states (for instance: Lagos) the VAT rate is different from 7.5%.

In addition, we highlight the possibility of an incidence of double taxation that could arise as a result of disagreements on the origin and destination of goods and services between states. When combined with the problem of businesses having to comply with multiple VAT laws across the country, this could depress the ease of doing business in Nigeria and also translate into higher prices of goods and services for the final consumers.

Also, it is highly probable that states lose out on the potential income as a result of the inefficiencies and complexities associated with tax collections, compliance, and enforcement.

It is important to highlight that the Federal Government is a definite winner in this situation considering that 50.17% of VAT receipts in 2020 was generated from import VAT and international services VAT, which is remitted directly to the FG. However, the FIRS may lose out on the income it earns from VAT collection fees- 4.0% of collections.

Bottom-Line

This recent development has highlighted the need to retool the VAT administration in Nigeria. While we acknowledge that a State VAT collection system may have its benefits, considering the peculiarities of the country, the possibility of a loss of income for states is high. This could be more complicated for states that do not have the required infrastructure and competence to efficiently administer VAT in their states, at a lower cost than the FIRS.

The jury is still out on what the future holds for VAT in Nigeria. Nonetheless, we hope the resolution would be one that resolves the issues of inequity, positively impacts the people without erasing the decade-long progress recorded.